What is GoCardless?

GoCardless is a direct debit payment provider integrated with Nexudus that lets you collect invoice payments automatically when invoices become Due.

Unlike card payment methods that often have payment caps, GoCardless lets you collect larger invoice payments.

How GoCardless Works

Setup

Adding GoCardless as a payment method in your space is a simple three-step process:

- Open a GoCardless account

- Enable GoCardless as a payment method in Nexudus

- Send a GoCardless signup request to customers through Nexudus

Once customers complete the signup request and the mandate is approved by their bank, you can start processing invoice payments using GoCardless.

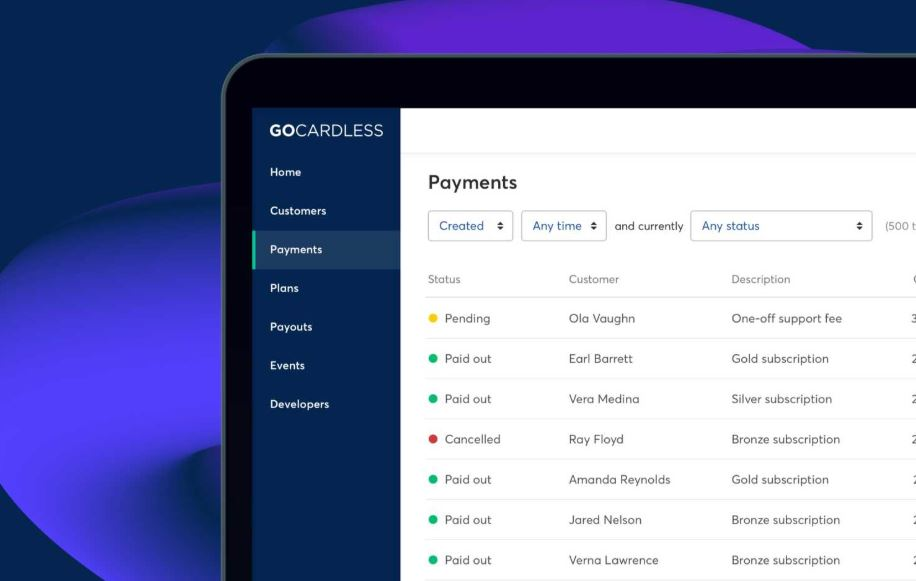

Payments

Once you set up GoCardless as a payment method, customers complete their direct debit request, and their bank approves the mandate, Nexudus automatically starts collecting payments on each invoice's due date.

For example, if a customer paid using Stripe, they'll always pay via direct debit once you enable GoCardless for them, even if they still have their card details on file.

If a customer is invoiced on the 1st of the month and their invoice becomes due on the 4th, your space won't receive any payment in GoCardless before the 7th.

Some payment schemes can take up to 9 business days to process payments. GoCardless details the payment processing time frames you can expect based on th payment scheme that your country uses.

Using GoCardless with other Payment Methods

While you can offer multiple payment options to your customers, you should be aware of the following limitations with GoCardless:

- You can only use one direct debit payment method per location.

If you decide to use GoCardless, you cannot use any other direct debit methods such as Stripe Direct Debits or Forte ACH.

- Using GoCardless as a payment method stops any automated card payment method a customer has on file, even if customers don't have a valid mandate.

For example, if customers used to pay their invoices using a card payment method and you enable GoCardless for them, Nexudus immediately stops automatically collecting payment via the card payment method they previously used.

If there is no valid GoCardless mandate in place by the time their next invoice becomes due, no payment is collected on the Due date, even if the customer still has their card details on file. Admins and customers can still manually pay invoices using the previous card payment option while the mandate is processing.

GoCardless Refunds

Refunding invoices originally paid through GoCardless is always a two-step process:

1. Recording the refund in Nexudus

You should start by recording the refund in Nexudus, making sure you select Direct debit (GoCardless) as the payment method. Refunding the customer helps you keep track of the refund in Nexudus, but it won't trigger any actual refund through GoCardless.

2. Sending the refund through GoCardless

Once you've recorded the refund in Nexudus, you should also manually refund your customer through GoCardless for the same amount you've refunded in Nexudus. This second step is crucial, as the customer won't receive their refund until you send it through GoCardless.

GoCardless Failed Payments

If a GoCardless payment fails and you'd like to trigger a new payment request in Nexudus, all you need to do is edit the invoice reference.

All invoices you issue have a unique idempotency key that payment providers use to identify each payment request. Once this key is used to request a payment, it can't be reused to prevent duplicate payments.

Editing your invoice reference effectively generates a new idempotency key and allows GoCardless to trigger second payment request for the same invoice.

You can edit your invoice reference by opening the invoice and then clicking on its reference.

For example, if your invoice reference is INV-0136, change the reference to INV-0136* or INV-0136New and then click Save changes.

Editing the number breaks your invoice sequence and shuts down automated invoicing. If you edit an invoice number, support will need to reset your invoice sequence to let you raise new invoices again.

Once you've edited the invoice reference, GoCardless will automatically try to collect payment for the invoice, based on the standard processing times that apply.

In this instance, you'll receive a failed payment notification from GoCardless, but the invoice will remain Paid in Nexudus.

To fix the issue and receive payment, you need to cancel the failed invoice and then issue a new invoice to trigger a new payment request.