You can manually generate an e-invoice for any invoice you issued with Nexudus. Generating e-invoices sends those invoice to your local tax authorities once you've enabled e-invoicing.

You need to generate e-invoices for invoices you've already issued and want to transfer to tax authorities. Generating e-invoices for invoices you've already issued, even when they are due, will never charge your customers twice.

Go to Settings > Integrations > E-invoicing, toggle on Automatically generate and send eInvoicing documents for all invoices issued, and save your changes.

You'll still need to manually generate e-invoices as detailed below for any invoice you've already issued to transfer them to tax authorities.

From the Finance section

Log in to dashboard.nexudus.com if you aren't already.

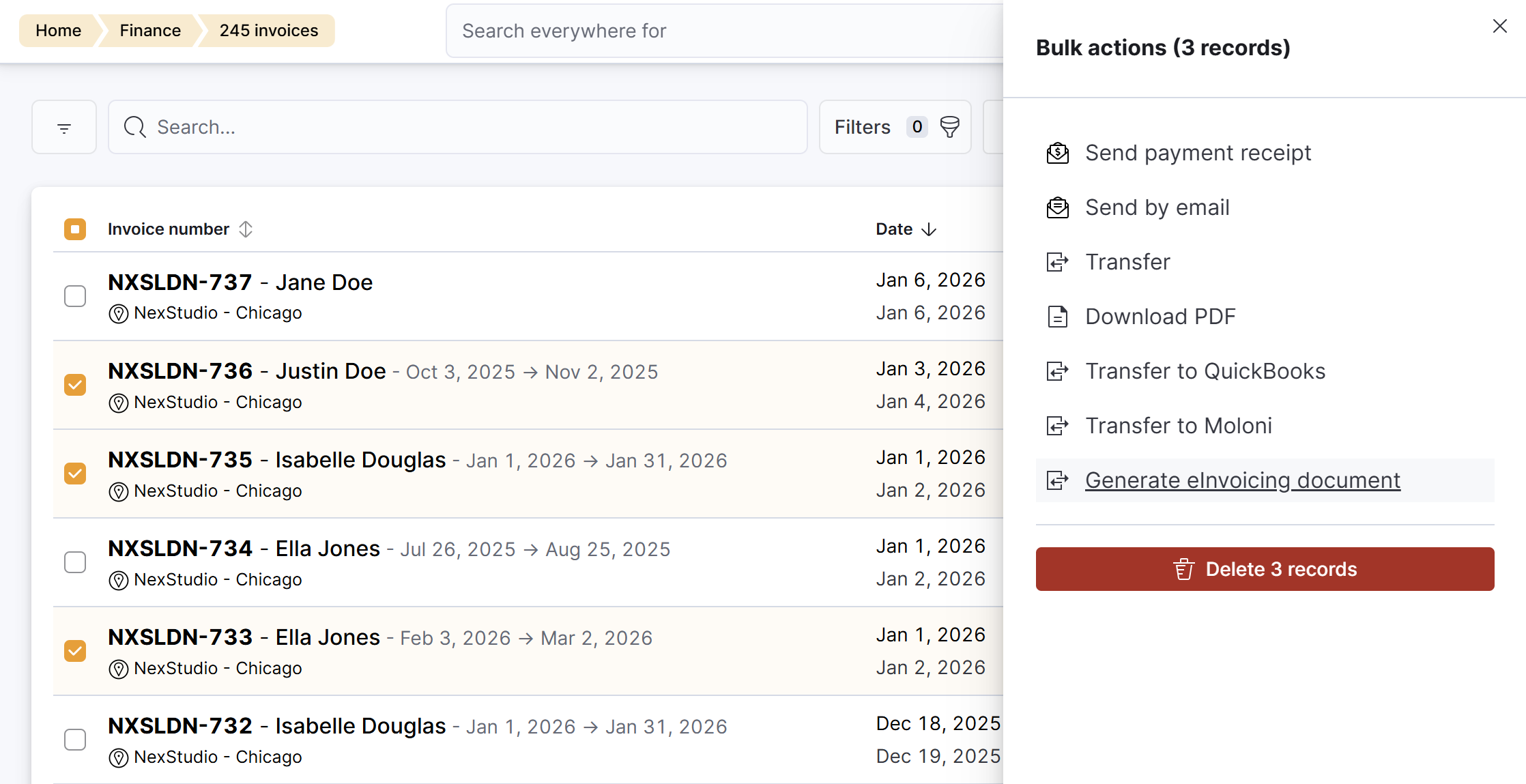

- Click Finance > Invoices.

- Tick the checkbox next to every invoice you'd like to generate an e-invoice for.

- Click on the Bulk actions button.

- Click on Generate eInvoicing document in the Bulk actions menu.

Click Yes, do it to confirm.

All set! You can check on any potential errors or transfer issues via Finance > eInvoicing errors on the Admin Panel.

From customer accounts

Log in to dashboard.nexudus.com if you aren't already.

- Click Operations > Members and contacts.

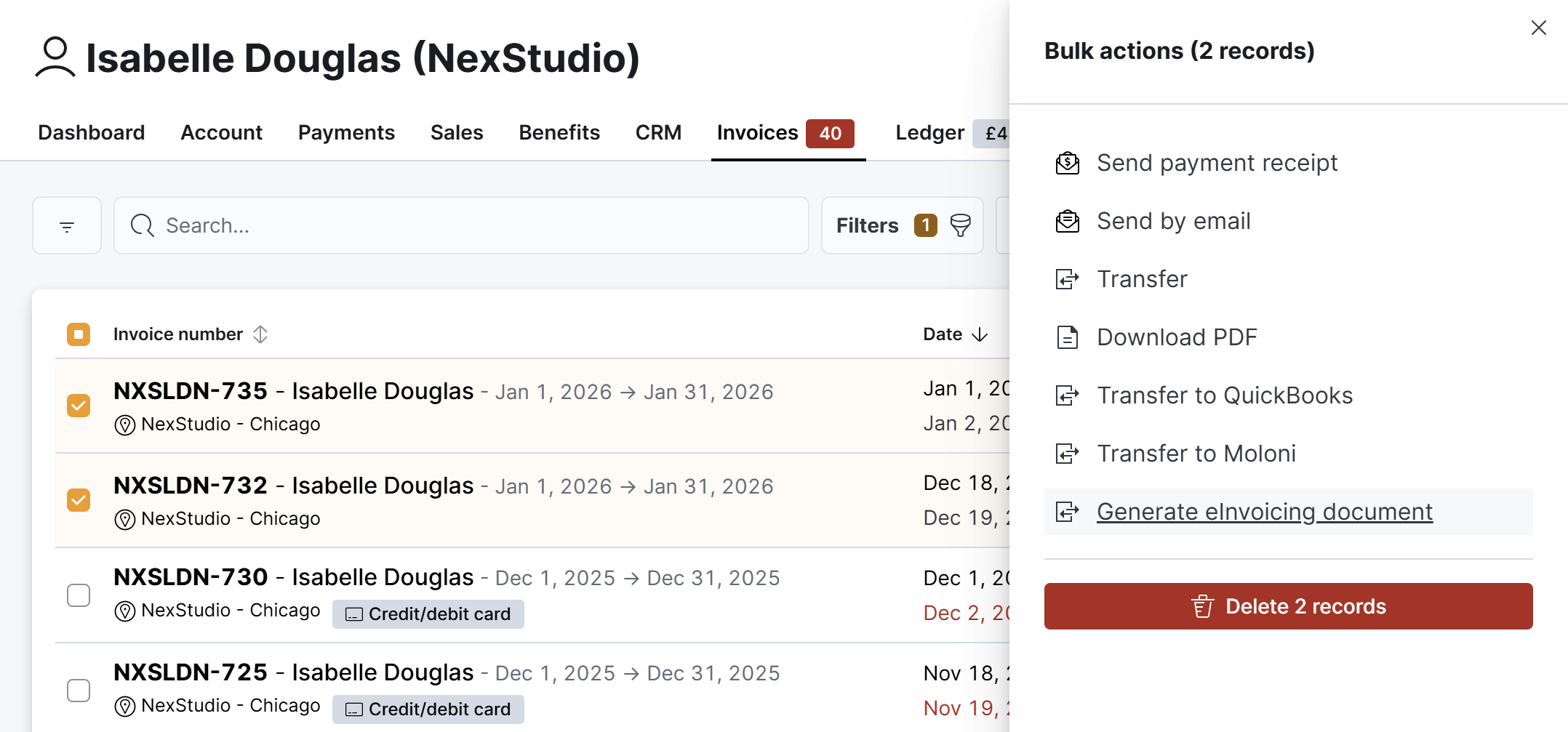

- Click on the relevant customer.

- Click on their Invoices tab.

- Tick the checkbox next to every invoice you'd like to generate an e-invoice for.

- Click on the Bulk actions button.

- Click on Generate eInvoicing document in the Bulk actions menu.

Click Yes, do it to confirm.

All set! You can check on any potential errors or transfer issues via Finance > eInvoicing errors on the Admin Panel.